Financial IT Solutions

Personalization and easy access to financial services are now the expectation all customers hold. Current technologies, including AI and big data management, enable organizations to offer new financial IT services to customers. However, these services can’t get off the ground with outdated infrastructure, underutilized data, or technology that doesn’t meet security and compliance standards.

Expectations Shift for Financial Services

The Financial services industry is looking to the cloud to enhance current business operations, resiliency, compliance, and prepare them for the future. Cloud adoption by financial service businesses is set to hit 90% by 2023.

Artificial intelligence will factor heavily into this. Over 80% of financial institutions believe that AI technology is a key driver for success. Adoption of this technology also meets expectations held by 66% of consumers who want to see real-time and personalized offers. They also want businesses to understand their unique needs and expectations.

The industry also has to adapt to changing expectations of their workforce. 60% of employees plan on continuing to work in a hybrid or remote capacity.

Security Threats Challenge Financial Services

What We Do

Build client experiences that drive revenue by partnering with TierPoint. Allow our managed services team to take on time-consuming IT tasks while serving as an extension of your staff. We provide strategic IT guidance and have experience in diverse skill sets, including cybersecurity, disaster recovery, and cloud services.

Transform Financial Services with the Cloud

With the right tools and IT infrastructure, financial services organizations can harness cloud capabilities to deliver an improved customer experience. A stronger emphasis on data and analytics can help organizations make more informed and efficient business decisions. All while helping create a more personalized experience for end users. Don’t let legacy systems hold you back.

Cloud technology can also support a hybrid workforce that can maintain top talent and improve employee satisfaction.

Balance Security and Transformation Initiatives

Technology decisions can affect strategic, regulatory, operational, financial, and risk to your reputation. Digital transformation can allow you to deliver engaging customer experiences and valuable insight. However, financial information also needs to be kept secure at all times.

Your customers expect an experience that is fast, frictionless, and amenable to self-service. Financial services organizations need to answer the call and grow while protecting valuable data.

Simplify and Optimize for IT Growth

Mergers and acquisitions (M&A) and growth over time can lead to IT infrastructure being pieced together from disparate and disconnected systems. You may find yourself investing significantly in legacy infrastructure that is keeping you from evolving. An IT overhaul can improve business performance and drive efficiencies. Your institution should be able to spend less time on administration and maintenance, leaving more time to focus on innovative services that can engage customers and drive revenue.

Capabilities

-

Cloud Services

Cloud-based technologies (like private and public cloud) can help you deliver enhanced digital experiences to meet customer expectations while managing stringent industry regulations for sensitive data. Our team of experts can help design, build and manage your cloud environment. So you can confidently host critical applications in the cloud.

-

Security and Compliance

Manage risk and secure sensitive data with a proactive, multi-layered security approach. Our experts can help financial services companies develop a strategy and deploy technologies that help meet regulatory compliance requirements. This includes PCI-DSS, GLBA and Sarbanes-Oxley.

-

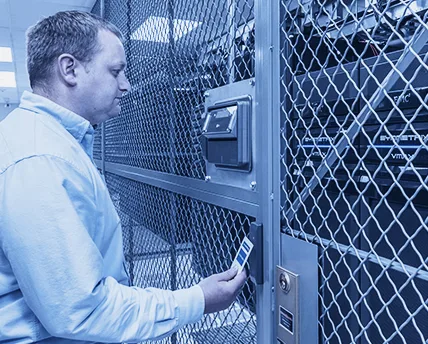

Data Center and Colocation Services

Our footprint of secure, compliant data centers is ideal for housing your legacy infrastructure or cloud environments. Meet regulatory requirements for financial services while also helping to ensure your apps and data are always available. Our facilities are backed by an industry leading SLA of 100% uptime for infrastructure components.

-

Disaster Recovery Services/

Customized recovery solutions help ensure the resilience of your business-critical data, applications, and infrastructure. It also helps maximize business continuity after a cybersecurity attack or natural disaster strikes. Disaster recovery as a service (DRaaS) solutions can ensure continuous availability and security of your data and IT systems.

Related Content

Case Study: RMS Uses Hybrid Cloud & DRaaS to Improve Performance and Reliability

White Paper: Avoiding Ransomware Attacks

Still have questions?

Let’s discuss how our financial industry expertise can help your business accelerate IT transformation, improve customer experience and unlock new revenue streams.